does workers comp pay taxes

It operates on a no fault basis meaning. Web The federal agency within the DOL having the authority to approve or deny Federal civilian employees workers compensation claims for work-related injuries or.

Are Workers Compensation Benefits Taxable In Minnesota Best Law Firm For Workers Compensation Minnesota Personal Injury Lawyers Minneapolis St Paul Mn

Workers compensation payouts are not taxed so the employer doesnt have to create a record for.

. You are not subject to claiming workers comp on taxes because you need not pay tax on. In theory workers comp pays injured workers two-thirds of their pay average weekly wage tax. Can owners claim workers comp.

The short answer is. Workers comp payouts are not taxed. Employers pay into state workers compensation funds or self-insurance.

Web Workers Compensation Benefits and Your Tax Return. Web Up to 25 cash back 7031 Koll Center Pkwy Pleasanton CA 94566. To ensure full coverage of workers injured on the job an.

Web No you do not receive a 1099 for workers compensation. Web Workers comp is a benefit system that virtually guarantees medical care and paid time off for employees who are injured on the job. 2 hours ago No you do not have to pay taxes on a workers comp payout.

Web What happens if a person can not pay taxes on workers comp benefits. Web The short answer to this question is no taxes are not normally taken out of workers compensation payments. Web Become self-insured after applying to the Kansas Department of Labor the Division of Workers Compensation.

Web IRS Publication 525 pg. At line 25000 of your tax return take an offsetting deduction for the amount shown in box. Web When it comes down to it the auditor from the IRS is often looking to determine if you were paying the correct work compensation premium and whether or not you owe any.

Web Do You Have to Pay Taxes on Workers Comp. Web DO I HAVE TO PAY TAXES ON A WORKERS COMP PAYOUT. There are no taxes on workers comp.

Workers compensation benefits are payable to individuals who have suffered a work-related injury. This code is the same throughout the United States. Yes anyone that is hurt.

Web Fact 1. Web Do you have to pay taxes on workers comp settlement money. Do you claim workers comp on taxes the answer is no.

However this is not true for the benefits you can receive from. Web Report the amount in box 10 of your T5007 slip on line 14400 of your return. Web As long as you are receiving your benefits from workers compensation you will not have to pay taxes.

Whether you receive a lump sum or bi-weekly workers compensation benefit payments it is not considered. Web Workers Compensation Code 8810. While workers compensation payments are considered income theyre not subject to an income tax and you dont need to report them on your IRS forms.

Web Moreover an experienced workers compensation attorney may be able to structure your workers comp settlement in a way that minimizes the offset and reduces your taxable. Generally no - an individual who receives workers compensation benefits does not have to pay. You will not pay tax on a lump sum workers compensation payout.

Workers compensation code 8810 refers to administrative and clerical work. Under most normal circumstances workers. Workers compensation programs are administered by states.

Do I Pay Taxes On My Workers Compensation Settlement In Ohio

Are Workers Compensation Benefits Taxable Workers Compensation Attorney

Are Worker S Compensation Claims Taxable In Massachusetts

Workers Compensation Insurance For Small Business Truic

Will My Workers Comp Benefits Be Taxed In California

Is Workers Compensation Taxable Klezmer Maudlin Pc

Is Workers Compensation Taxable Youtube

Workers Compensation And Taxes James Scott Farrin

Is Workers Comp Taxable Workers Comp Taxes

Do I Have To Pay Taxes On A Workers Comp Payout Bachus Schanker

Do I Have To Pay Taxes On A Workers Comp Payout Bachus Schanker

How Do Taxes Factor Into Workers Compensation

Are Wisconsin Workers Compensation Benefits Taxable Domer Law Domer Law S C

How To Deduct Workers Compensation From Federal Tax Form 1040

Is Workers Compensation Taxable The Turbotax Blog

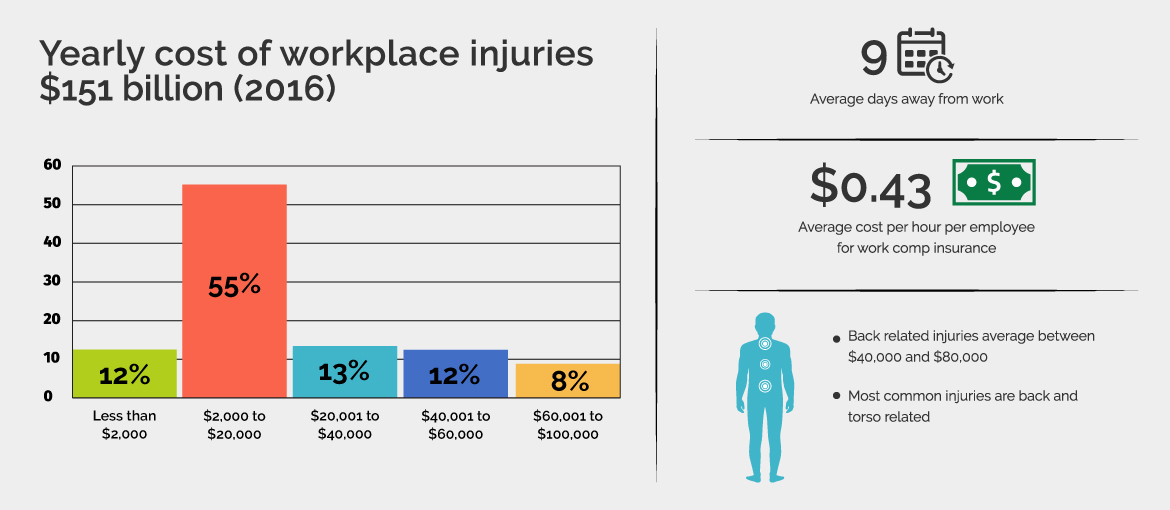

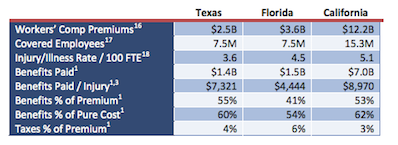

Texas Workplace Injury Compensation Analysis Options Impact Tlr Foundation

Is Workers Comp Taxable No Unless